learn about selecting analytical instruments

Are you selecting analytical instruments for your Mexican laboratory? Whether you work in agave research, water treatment, or pharmaceuticals, learn how to choose reliable tools that meet local standards, adapt to Mexico’s climate, and mesh with your industry and budget needs.

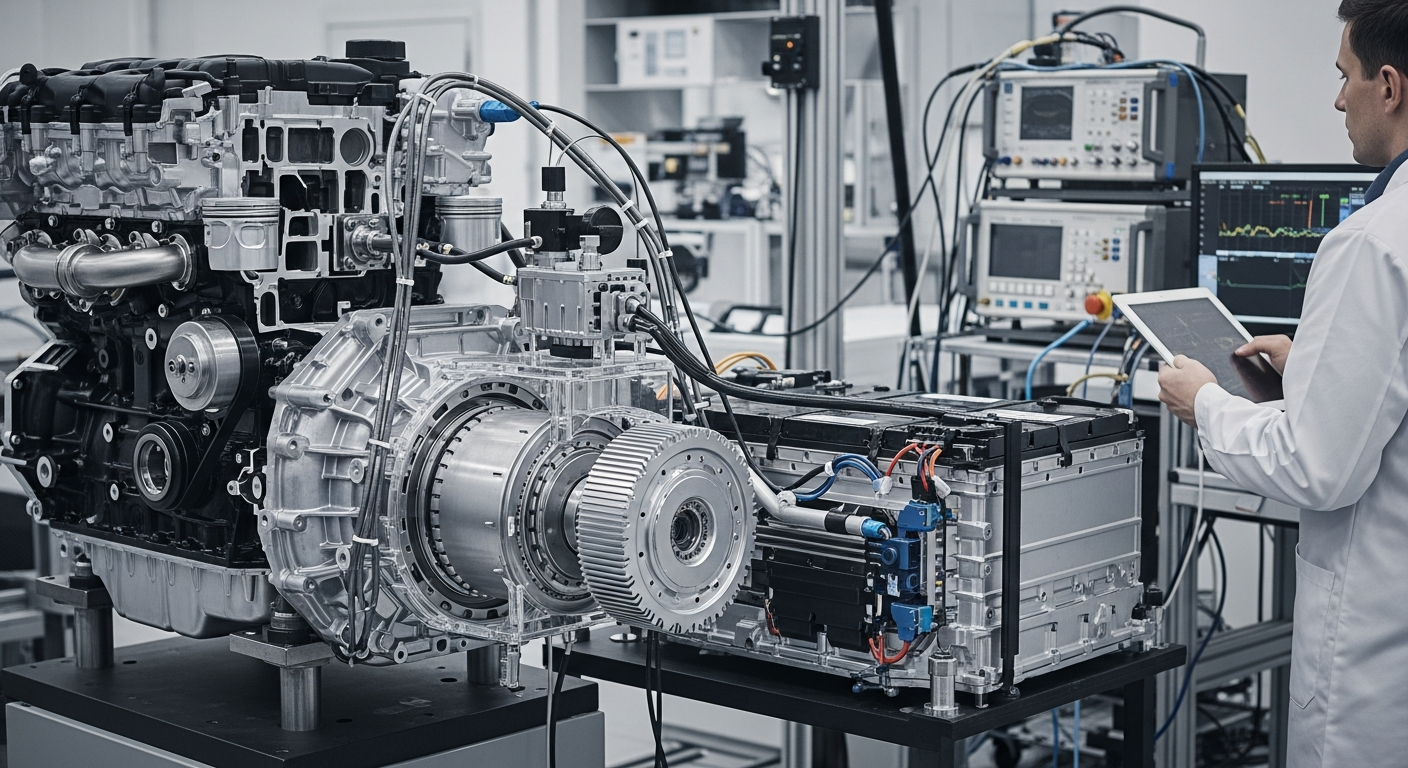

Choosing analytical instruments involves more than comparing technical specifications. Organizations must evaluate how equipment aligns with their operational requirements, regulatory obligations, and environmental conditions. For Mexican users, this process requires attention to local industry standards, climate factors, and the availability of qualified support services. Understanding these elements helps ensure that investments in analytical technology deliver reliable, long-term value.

Understanding Local Industry Requirements in Mexico

Mexican industries operate under specific technical and operational standards that influence instrument selection. Manufacturing sectors, pharmaceutical companies, environmental testing laboratories, and academic institutions each have distinct analytical needs. For example, pharmaceutical facilities must meet stringent quality control protocols, while environmental labs require equipment capable of detecting specific contaminants relevant to Mexican ecosystems. Understanding these sector-specific requirements helps narrow down suitable instrument types and configurations. Organizations should assess their testing volume, required detection limits, sample types, and data management needs before evaluating specific models. Consulting with industry peers and reviewing sector guidelines provides valuable insight into which instruments deliver optimal performance for particular applications.

Navigating Mexican Regulatory and Quality Standards

Compliance with Mexican regulatory frameworks is essential when selecting analytical instruments. The Federal Commission for Protection against Sanitary Risks (COFEPRIS) oversees standards for healthcare and pharmaceutical sectors, while the Ministry of Environment and Natural Resources (SEMARNAT) establishes environmental testing protocols. Industrial operations may need to comply with Mexican Official Standards (NOMs) relevant to their sector. Instruments must be capable of meeting method validation requirements, producing traceable results, and maintaining calibration records according to local regulations. Buyers should verify that equipment comes with proper documentation, including certificates of analysis, calibration certificates, and compliance statements. Working with suppliers familiar with Mexican regulatory requirements simplifies the validation process and ensures that instruments meet necessary quality standards from the outset.

Sourcing Instruments Suited for Mexicos Climate

Mexico’s diverse climate zones present specific challenges for analytical equipment. Coastal regions experience high humidity and salt air exposure, while northern areas face extreme temperature variations. High-altitude locations may affect instrument performance due to atmospheric pressure differences. Laboratory equipment must maintain stable operation despite these environmental factors. When evaluating instruments, consider specifications for operating temperature ranges, humidity tolerance, and environmental sealing. Equipment designed for tropical or subtropical conditions often includes enhanced corrosion protection and climate-controlled components. Facilities should also assess their laboratory infrastructure, including HVAC systems, to ensure they can maintain manufacturer-recommended environmental conditions. Instruments with robust construction and proven performance in similar climates reduce the risk of premature failure and costly downtime.

Budgeting and Supplier Selection in the Mexican Market

Financial planning for analytical instruments extends beyond initial purchase prices. Organizations must account for installation costs, training expenses, consumables, maintenance contracts, and potential upgrades. Currency fluctuations can impact total costs when purchasing imported equipment. Creating a comprehensive budget that includes these factors prevents unexpected expenses and helps secure adequate funding.

| Equipment Category | Typical Cost Range (MXN) | Key Considerations |

|---|---|---|

| Basic Spectrophotometers | 60,000 - 300,000 | Suitable for routine analysis, lower maintenance |

| Gas Chromatography Systems | 400,000 - 1,600,000 | Requires specialized training, regular consumables |

| Mass Spectrometry Systems | 2,000,000 - 10,000,000+ | High operational costs, expert technical support |

| pH Meters and Basic Instruments | 10,000 - 100,000 | Lower entry cost, frequent calibration needs |

| HPLC Systems | 600,000 - 3,000,000 | Moderate maintenance, solvent costs |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Supplier selection requires evaluating multiple factors beyond price. Established distributors with local presence in Mexico offer advantages including faster delivery, Spanish-language support, and familiarity with import procedures. Assess suppliers based on their technical expertise, spare parts availability, service response times, and customer references. International manufacturers with authorized Mexican representatives typically provide better warranty support than gray-market sellers. Request detailed quotations that specify all included components, training provisions, and warranty terms to enable accurate comparisons.

Training and Technical Support for Mexican Users

Effective instrument operation depends on proper training and accessible technical support. Users need comprehensive instruction covering routine operation, basic troubleshooting, maintenance procedures, and safety protocols. Suppliers should offer training in Spanish, either on-site or at regional facilities, with materials tailored to Mexican regulatory requirements. Ongoing technical support is equally critical. Evaluate whether suppliers provide local service technicians, remote diagnostic capabilities, and reasonable response times for repairs. The availability of Spanish-language technical documentation, user manuals, and software interfaces improves user competency and reduces operational errors. Organizations should also consider establishing relationships with independent service providers as backup support options. Investing in thorough training and reliable support infrastructure maximizes instrument uptime and ensures that analytical data meets quality standards.

Making Informed Decisions

Selecting analytical instruments for Mexican applications requires balancing technical performance, regulatory compliance, environmental suitability, budget constraints, and support infrastructure. Organizations benefit from developing clear selection criteria based on their specific analytical needs and operational context. Engaging stakeholders from laboratory staff, quality assurance teams, and procurement departments ensures that all relevant perspectives inform the decision. Requesting equipment demonstrations, reviewing case studies from similar Mexican facilities, and conducting site visits to supplier service centers provide valuable insights. Taking time to thoroughly evaluate options and plan for long-term operational requirements leads to instrument selections that deliver reliable performance and support organizational goals effectively.